THE SRV EXPOSITOR

"The past and the present are within my field of inquiry." — Sherlock Holmes,

in The Hound of the Baskervilles

SRVUSD FINANCES

Be sure to visit the Personnel page also. SRVUSD's claimed financial problems are of their own making. Employee numbers and compensation increases have both been grossly disproportionate with the combined effects of inflation (increases yes, but...), accompanied since 2017-18 by severely declining enrollment.

Part of the reason for such dollar disproportions is that SRVUSD has more employees now than it did 10 years ago, when the District had 3400 fewer students — yet performed better on CAASPP tests.

And for the 2025-2026 school year, SRVUSD expects to have 4,502 fewer students than they had in 2015-2016, but still to have more employees than then, even after their projected "reduction in force" layoffs.

We've heard lately that some SRVUSD teachers have been complaining that their compensation has [allegedly] not kept pace with inflation since 2019. But the reality is summarized below. Note that raises have been retroactive to the previous July, and that in addition to the raises with asterisks, "one-time" 1% amounts were also supplied.

Essentially: SRVUSD's out-of-proportion compensation increases over time have themselves become a local inflationary effect.

Nevertheless, SRVUSD tax promoters were able to convince enough voters in a second go-round on 2024's parcel-tax renewal campaign (Measure Q) — despite an 8.5 % retroactive raise in late 2022 and another 6.0% raise in February 2024 (both with an extra 1% "one-time" bonus addition — that they've been able to continue the existing parcel tax (netting about $7 Million annually).

The District itself spent over $300,000 in taxpayer funds for campaign consultants and promotional mailings in pushing (a) failed measures E and F (with E including a sneaky inflation escalator clause, F a straight up addition) and (b) Measure Q's simple renewal.

The failed Measure E & F SPECIAL election in May of 2024 cost them over $1.1 Million in County Election Office expenses for mailing and processing the ballots involved. Their Measure Q Election cost (their second parcel-tax renewal attempt, this time without a sneaky inflation escalator or a flat increase) was much less, a little under $188,000. That was because they consolidated that election effort with the November 2024 General Election.

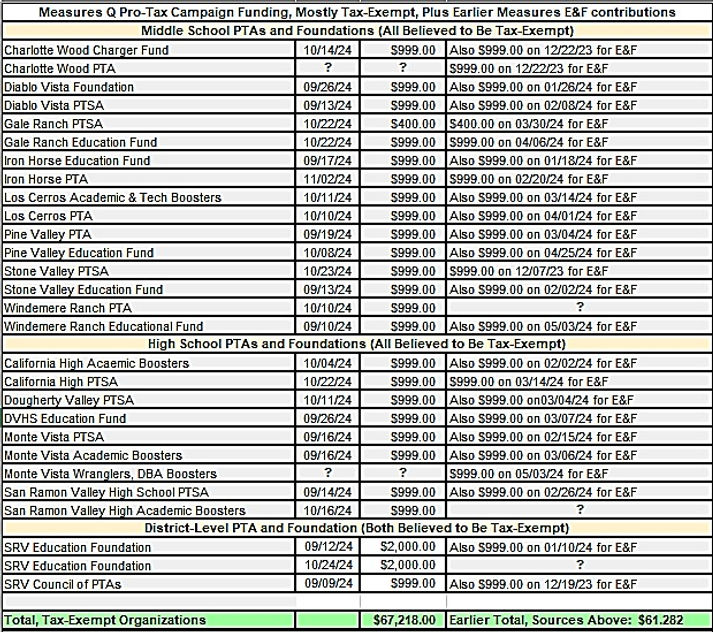

In addition to SRVUSD's own election maneuvering, their tax-exempt PTAs and some of their existing and/or prospective vendors of goods and services contributed significant sums to their "private" 2024 parcel-tax campaigns. See the table below. The numbers shown are believed to be accurate, based on Election Office posted records.

Realize what this means: tax-exempt entities spent large sums to add nine more years of parcel taxes.

And to us, the additional contributions by SRVUSD vendors smell like shakedowns and (at least potential) kickbacks, though direct quid pro quo connections are difficult or impossible to establish.